انضم إلى تحدي PU Xtrader اليوم

تداول برأس المال المحاكي واحصل على أرباح حقيقية بعد اجتياز برنامج تقييم المتداول الخاص بنا.

انضم إلى تحدي PU Xtrader اليوم

تداول برأس المال المحاكي واحصل على أرباح حقيقية بعد اجتياز برنامج تقييم المتداول الخاص بنا.

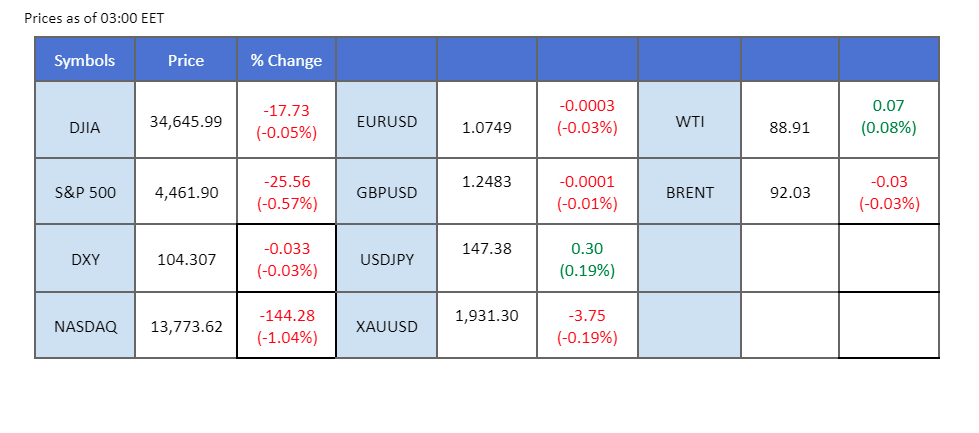

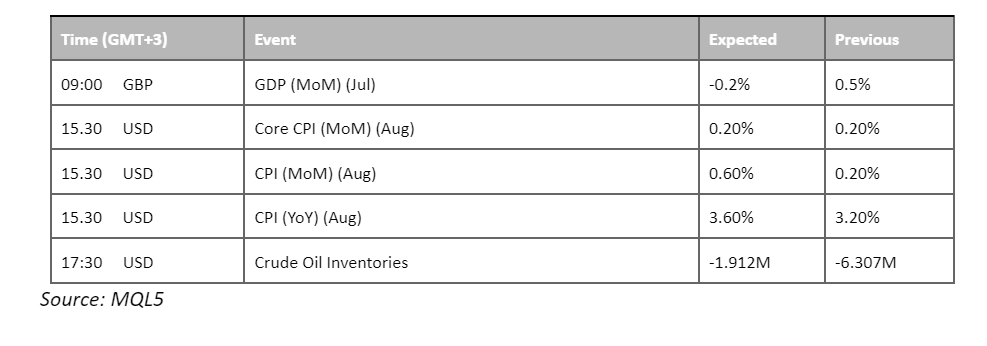

The dollar index remained stable near $104.5 as the market awaited the release of U.S. CPI data, causing fluctuations in the equity and gold markets due to speculation about a potential Fed rate hike next week. Anticipating a higher CPI reading, the market expects the Fed to continue raising rates to combat inflation and bring it back down to the target of 2%. Meanwhile, oil prices continued their upward trend, with WTI approaching the $90 mark, driven by the OPEC monthly report forecasting a 3.3 million barrel per day shortfall in the 4th quarter. In contrast, Japan’s annual wholesale inflation eased in August for the 8th consecutive month, reducing the strength of the Japanese yen.

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (93.0%) VS 25 bps (7.0%)

The US dollar maintained its stability as investors eagerly awaited the release of crucial US consumer inflation data. All eyes are on this data as it is expected to shape the Federal Reserve’s decision in the upcoming week. Economists anticipate a potential uptick in inflation for August due to rising energy costs, which could prompt the Fed to consider further rate hikes.

The dollar index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 105.25, 106.25

Support level: 104.25, 103.05

Gold prices saw a decline after breaching a significant support range. Market sentiment remains skewed towards a hawkish stance from the Federal Reserve, as evidenced by rising US Treasury yields and the US dollar’s six-month high. The release of CPI data adds to market volatility, advising caution for investors in their trading strategies.

Gold prices are trading lower while currently testing the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 37, suggesting the commodity might enter oversold territory.

Resistance level: 1930.00, 1950.00

Support level: 1910.00, 1900.00

The euro saw a modest rebound following reports that the European Central Bank (ECB) expects inflation in the eurozone to remain above 3% in the coming year. This reinforces the case for a tenth consecutive interest rate increase during the ECB’s upcoming meeting. However, the ECB faces a delicate balancing act, with high inflation and recession concerns causing uncertainty about whether they will pause or proceed with another rate hike.

EUR/USD is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 1.0915, 1.1060

Support level: 1.0710, 1.0530

The British pound (Sterling) remains in a bearish trend below its long-term downtrend resistance level, currently testing a critical support level at 1.2460. The market is anticipating a higher U.S. CPI, scheduled for release later today, which has kept the dollar steady above $104.50. This anticipation is fueled by expectations of a further rate hike from the Federal Reserve. Additionally, the UK’s GDP data is set to be released today, and investors will closely watch this reading to assess the strength of the Sterling.

The Sterling is forming a descending triangle price pattern and is suggesting a bearish signal for the Cable. The RSI continues to flow in the lower region while the MACD moves toward the zero line, suggesting the momentum is lacking.

Resistance level: 1.2540, 1.2640

Support level: 1.2460, 1.2390

The Japanese yen has eased from its recent bullish momentum against the U.S. dollar following a hawkish statement from the BoJ Chief over the weekend. However, as the release date for the U.S. CPI approaches, the market speculates that the CPI reading will come in higher than the previous figure, potentially leading to a continuation of rate hikes by the Federal Reserve next week. This expectation is bolstering the U.S. dollar. Additionally, Japan’s August annual wholesale inflation slowed, further weakening the yen.

USD/JPY is trading toward its crucial strong resistance level at 147.80, a break above will serve as a solid bullish signal for the pair. The MACD has rebounded at the zero line while the RSI gained to above the 50-level, suggesting the bullish momentum is forming.

Resistance level: 147.75, 149.30

Support level: 146.25, 144.70

The US equity market experienced a slight retreat as risk-off sentiment prevailed ahead of the crucial CPI data release. Oracle’s shares took a significant hit, plummeting more than 13%, following a disappointing forecast. The company’s weak performance and revenue projections contributed to the market’s negative sentiment.

Nasdaq is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 49, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 15780.00, 16585.00

Support level: 14610.00, 13660.00

The bullish momentum for the Australian dollar has waned, with the currency facing pressure as the U.S. dollar strengthened last night in anticipation of the U.S. CPI release. Market expectations suggest that the Federal Reserve may continue to raise interest rates next week, as there is speculation that the CPI reading will surpass the previous figure. Additionally, investors are likely to focus on Australia’s employment change data and unemployment rate, set to be released tomorrow, to assess the strength of the Aussie dollar.

The AUD/USD pair’s bullish momentum has eased after consolidating at near 0.6430. The RSI is declining while the MACD stays flat near the zero line, suggesting the pair’s bullish momentum has vanished.

Resistance level: 0.6500,0.6610

Support level: 0.6370, 0.6200

Oil prices continued their upward trajectory, reaching a new 10-month high. Expectations of tightened global supply and concerns over supply disruptions in Libya outweighed worries about reduced demand in certain countries like China. The closure of Libyan oil export terminals due to a severe storm further supported oil prices. OPEC’s optimistic outlook on global oil demand growth in 2023 and 2024 adds to the bullish sentiment.

Oil prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 70, suggesting the commodity might enter overbought territory.

Resistance level: 92.30, 95.80

Support level: 87.70, 84.45

Trade with simulated capital and earn real profits after you pass our trader assessment.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment