انضم إلى تحدي PU Xtrader اليوم

تداول برأس المال المحاكي واحصل على أرباح حقيقية بعد اجتياز برنامج تقييم المتداول الخاص بنا.

انضم إلى تحدي PU Xtrader اليوم

تداول برأس المال المحاكي واحصل على أرباح حقيقية بعد اجتياز برنامج تقييم المتداول الخاص بنا.

28 June 2023,05:59

Daily Market Analysis

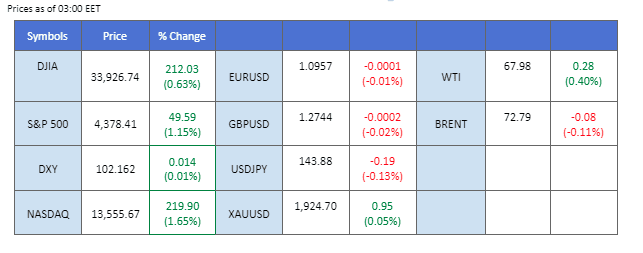

Political instability in Russia has abated as Prigozhin’s troops retreat from Moscow, leading to a positive response in equity markets, particularly the Nasdaq, which rose over 1%. Oil and gold prices declined as the situation in Russia stabilised, with risk sentiment improving. Australia’s inflation rate eased more than expected, raising the possibility of the Reserve Bank of Australia (RBA) pausing its monetary tightening cycle, causing the Australian dollar to plunge against the USD. Additionally, the Japanese yen is trading at its weakest level in eight months against the USD and at a 15-year low against the euro, with economists suggesting that the Bank of Japan (BoJ) may intervene in currency markets if the yen reaches 150 against the USD.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (26%) VS 25 bps (74%)

China’s proactive measures to stabilise its currency, the yuan, have exerted downward pressure on the US dollar. The People’s Bank of China (PBOC) took decisive action after nearly eight months by setting a stronger-than-expected trading band for the yuan and directing state banks to sell dollars. This move represents a clear indication of the authorities’ concern regarding the yuan’s decline. As a result, the US dollar has depreciated despite the positive economic data from the US, which typically strengthens the currency.

The dollar index is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the index might extend its losses toward support level.

Resistance level: 102.75, 103.35

Support level: 102.00, 101.35

Positive US economic indicators, including Building Permits, Core Durable Goods Orders, and CB Consumer Confidence, have surpassed market expectations. Building Permits rose to 1.496 million, exceeding the consensus of 1.491 million. Core Durable Goods Orders reached 0.6%, beating projections of -0.10%, while CB Consumer Confidence stood at 109.7, surpassing the expected 104.0. These indicators have prompted investors to shift away from gold, favouring riskier assets in a thriving economy.

Gold prices are trading lower while currently testing the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 41, suggesting the commodity might be traded higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1930.00, 1955.00

Support level: 1910.00, 1895.00

Euro gained with fresh ECB Hawkish rhetoric last night with the ECB president saying the rates need to be sufficiently higher to be in a restrictive territory. However, the German Bund yield showed that the country might be getting into recession which may have hindered the ECB to be more aggressive in its monetary policy. Meanwhile, the Fed sounded hawkish in its semi-annual monetary reports suggesting a pullback in euro pairs.

The EUR/USD rebounded and went sideways but it was able to hold on above 1.0944 Fibonacci 38.2% suggesting the bullish momentum is still intact. The RSI rebounded and stay above the 50-level while the MACD broke above the zero line both suggesting a bullish bias signal for the pair.

Resistance level: 1.1027, 1.1088

Support level: 1.0892, 1.0848

The RBA surprised the market by adding another 25 bps to its interest rate last month when the market expected the Australian central bank may pause its rate hike cycle due to uncertainty over the economy. As such, investors expect the RBA to continue to raise its interest rate as the policymakers sounded hawkishly recently, claiming the labour market is tight and the service sector inflation is high. However, the Aussie dollar plunged after Australia’s CPI was released. The data came lower than expected, prompting the RBA to pause its rate hike cycle next month.

The Aussie dollar has been trading in a downtrend channel since last week and the fundamental analysis is backing the trend. The RSI continues to flow in the lower region with the MACD flowing flat as well.

Resistance level: 0.6718, 0.6767

Support level: 0.6612, 0.6550

The Japanese Yen extended its losses as divergence in monetary policies between the Bank of Japan (BoJ) and other major central banks, creating concerns about potential import cost surges. As the BoJ maintains a more accommodative stance while other central banks consider tightening, the yen’s appeal has diminished, leading to selling pressure. This depreciation raises worries about increased import costs for consumers, potentially impacting inflation, and household budgets. Japanese authorities face mounting pressure to act if the yen’s decline accelerates, with potential warnings and decisive measures against speculative moves being considered. Close monitoring of the situation and further policy responses may be necessary to address these challenges.

USD/JPY is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 71, suggesting the pair might enter overbought territory.

Resistance level: 145.25, 150.00

Support level: 141.55, 138.90

Pound Sterling is trading in an extended consolidation range and has strong support at near 1.2700. There is a lack of catalyst to move the price movement of the cable until the UK releases its GDP data on coming Friday (30th June). Meanwhile, the hawkish statement from Jerome Powell last week prompted the Fed may continue raising rates next month which will pressure the Sterling to trade higher.

The cable has eased but is supported at Fibonacci 68.2% level and provides a trend reversal signal for the cable. The RSI went sideways, given a neutral signal and the MACD flow along with the zero line suggesting an easing from bearish momentum.

Resistance level: 1.2775, 1.2840

Support level: 1.2700, 1.2640

Despite geopolitical turmoil in Russia, the US equity market has remained positive, the Dow added another 212 points or 0.60% while ending its six-day losing streak. Investors’ optimism, fueled by strong economic data, has driven market optimism and prompted a shift towards riskier assets.

The Dow is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 52, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 34460.00, 35485.00

Support level: 33715.00, 32695.00

Oil prices have experienced a significant decline as investors reevaluate the impact of recent geopolitical turmoil in Russia. Concurrently, global central banks’ monetary tightening measures persist, with the European Central Bank (ECB) emphasising the need for rate hikes due to persistent high inflation. Furthermore, upbeat economic data from the United States has increased the likelihood of additional rate hikes by the Federal Reserve. However, the oil market’s losses have been somewhat limited by favourable oil inventory data, which revealed a larger-than-expected decrease in US crude oil stocks, as reported by the American Petroleum Institute (API).

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 33, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 70.00, 73.90

Support level: 67.25, 64.90

Trade with simulated capital and earn real profits after you pass our trader assessment.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment