انضم إلى تحدي PU Xtrader اليوم

تداول برأس المال المحاكي واحصل على أرباح حقيقية بعد اجتياز برنامج تقييم المتداول الخاص بنا.

انضم إلى تحدي PU Xtrader اليوم

تداول برأس المال المحاكي واحصل على أرباح حقيقية بعد اجتياز برنامج تقييم المتداول الخاص بنا.

26 June 2023,05:51

Daily Market Analysis

The rule of Russian President Vladimir Putin, who has held power for 23 years, is facing a significant challenge as the Wagner mercenary group advances towards Moscow. This development has caused concerns in the global energy market, leading to a rise in oil prices due to fears of potential disruptions. Simultaneously, investors have been selling riskier assets, resulting in a decline in equity markets, while investors have turned to gold, leading to a slight increase in prices. On the other hand, a member of the Bank of Japan’s policy board has called for an early discussion to revise the bank’s yield curve control, as revealed in the meeting minutes. If the current monetary stimulus policy of the Bank of Japan is terminated, it is expected that the Japanese Yen will strengthen against other currencies.

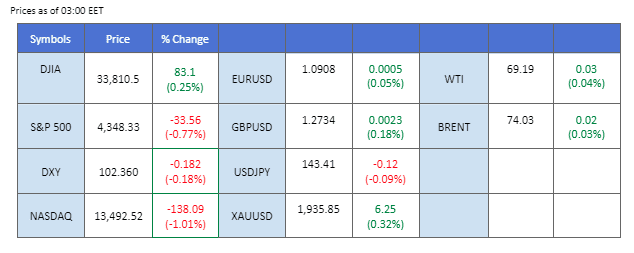

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (26%) VS 25 bps (74%)

As the Russia-Ukraine crisis escalates, global financial markets are witnessing a renewed surge in safe-haven demand, driving the US Dollar to gain strength. Governments around the world are closely monitoring the rapidly evolving events, and amidst this backdrop, the US Dollar stands tall as a preferred currency in times of uncertainty. In the coming days, as attention shifts to key economic indicators such as the personal consumption expenditures price index and other economic data, investors will closely watch the US Dollar’s trajectory amidst ongoing global economic concerns and geopolitical uncertainties.

The dollar index is trading lower as investors took-profit while currently testing the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 56, suggesting the index might be traded lower as technical correction since the RSI retraced sharply from its overbought territory.

Resistance level: 103.35, 103.90

Support level: 102.75, 102.00

Gold prices surged as the spotlight shifts towards the escalating geopolitical risks between Russia and Ukraine. Uncertainty surrounding the situation has prompted governments worldwide to closely monitor the rapidly unfolding events. The resurgence of geopolitical tensions triggered a rebound in safe-haven assets, including gold.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 46, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 1930.00, 1955.00

Support level: 1895.00, 1865.00

Euro hammered down by more than 0.5% last Friday while the dollar index advanced and hit $103 due to the Russian political uncertainty escalated. The Russia mutiny spurred the risk-off sentiment in the market and investors sought after safe haven assets, including the dollar which bolster the dollar to trade higher. Icing on the cake, the hawkish statement released last week in the Fed’s semi-annual monetary policy has also helped to strengthen the dollar but will put pressure on the euro simultaneously.

The EUR/USD pair dropped by more than 0.5% due to the strengthening dollar. RSI declined form overbought to below the 50-level while the MACD breaking below the zero line, signalling a bearish signal for the pair.

Resistance level: 1.0951, 1.1030

Support level: 1.0892, 1.0848

Japanese Yen slumped to its weakest level this year, losing ground against all major currencies within the Group-of-10. Market experts attribute this slide primarily to the widening gap between Japan’s accommodating monetary policy and the significantly more assertive measures implemented by its major counterparts to combat inflation through interest rate hikes. This growing disparity has fueled selling pressure on the Yen, leaving traders disheartened by the currency’s lacklustre performance.

USD/JPY is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, however RSI is at 51, suggesting the pair might enter overbought territory.

Resistance level: 145.25, 150.00

Support level: 141.55, 138.90

Pound Sterling eased from last week’s bullish momentum and is buoyed above 1.2700 level, while the dollar has strengthened over the Russian mutiny. The greenback rose slightly while the market has signs to protect their capital with safe haven assets as the Russia event continues to develop. In contrast, the surprise size of the rate hike from the BoE failed to support the Sterling to trade higher as the market worries that such an aggressive rate hike could cause economic damage. The recession alarm is ringing in the Euro region, including the UK with reference to the bond market.

The cable has lost steam and declined to the 1.2700 support level. The RSI decline from the overbought zone while the MACD crossed on above the zero line both suggest a trend reversal for the cable.

Resistance level: 1.2775, 1.2840

Support level: 1.2700, 1.2630

Escalating geopolitical tensions in Russia caused a slight retreat in the US equity market, as investors sought safer assets amidst uncertainties. A brief rebellion by Russian mercenaries resulted in the seizure of Rostov and an advance towards Moscow, demanding the removal of military commanders in charge of the Ukraine conflict. However, the Wagner army withdrew after securing a deal for their safety and their leader’s exile to Belarus. This development, acknowledged by US Secretary of State Antony Blinken, may unfold over months, leaving the overall war outlook uncertain. Investors adopted a cautious approach, waiting to see how events would unfold.

The Dow is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 44, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 34460.00, 35485.00

Support level: 33715.00, 32695.00

Oil prices staged a robust recovery driven by mounting geopolitical tensions involving Russia, which have ignited fresh concerns about future oil supply. The global financial markets are now focusing on the escalating geopolitical risks between Russia. The uncertainties surrounding the situation have triggered heightened vigilance among governments worldwide, as they closely monitor the rapidly evolving events. Besides, economic indicators from China will also be in the spotlight as concerns arise over the faltering recovery in the world’s second largest economy.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 48, suggesting the commodity might extend its gains after successfully breakout above the resistance level.

Resistance level: 70.00, 73.90

Support level: 67.25, 64.90

Trade with simulated capital and earn real profits after you pass our trader assessment.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment